Secure Your Financial Investment With Versatile Difficult Money Financings

Versatile hard cash fundings offer a compelling choice to traditional financing, focusing on the worth of the residential property over the borrower's credit report history. As we discover the subtleties of difficult cash finances, including their advantages and application procedures, it ends up being clear that recognizing these financing options can considerably affect your investment technique.

What Are Hard Money Lendings?

When checking out funding choices, numerous individuals run into hard cash lendings, which are short-term car loans safeguarded by genuine residential property. Mostly utilized in realty deals, difficult cash finances are commonly released by private capitalists or companies as opposed to standard economic organizations. These fundings are usually sought by borrowers that require quick accessibility to funding, such as actual estate capitalists wanting to purchase, renovate, or flip properties.

Tough cash car loans are identified by their expedited approval processes and much less stringent qualification requirements compared to standard loans. As opposed to concentrating mainly on a consumer's credit reliability, loan providers evaluate the underlying worth of the residential or commercial property being made use of as security. This strategy enables faster transactions, making difficult money finances an enticing choice in affordable real estate markets.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Benefits of Flexible Financing

Flexible funding choices, especially in the realm of tough money fundings, offer numerous advantages to customers navigating the dynamic actual estate market. One of one of the most significant advantages is the speed of financing. Conventional finances frequently include lengthy approval processes, whereas difficult cash car loans can be secured rapidly, permitting financiers to seize time-sensitive possibilities.

Furthermore, flexible funding accommodates different kinds of homes and investment techniques. Customers can make use of these loans for fix-and-flip tasks, rental buildings, or even commercial endeavors, thus widening their investment perspectives. This adaptability is particularly beneficial in a fluctuating market where conventional loan providers might enforce stringent requirements.

In addition, hard money car loans often come with less rigid credit scores needs. Financiers who may battle to certify for standard financing because of past credit history problems still have the chance to safeguard financing, empowering them to go right here seek their financial investment goals.

How to Receive a Financing

Certifying for a hard cash lending includes a number of key aspects that possible consumers need to comprehend to enhance the application procedure. Unlike standard car loans, difficult cash lenders concentrate largely on the worth of the property being utilized as security as opposed to the customer's debt background or earnings. Therefore, a complete assessment of the residential property is vital to establish its market price, which considerably affects the financing quantity.

Prospective borrowers need to likewise demonstrate a clear understanding of their financial investment strategy, showcasing exactly how they prepare to make use of the funds and the potential for residential or commercial property appreciation. Lenders normally need a deposit, varying from 20% to 40%, showing their rate of interest in decreasing risk.

Having a well-prepared exit method, describing just how the funding will be repaid, is essential. By addressing these elements, customers can considerably boost their chances of qualifying for a hard cash car loan, promoting a smoother funding experience for their investments.

The Application Process Explained

The application procedure for a tough money funding is uncomplicated yet requires careful prep work and paperwork. Normally, the very first action includes identifying a reliable hard cash lending institution that specializes in your kind of financial investment. Once you have actually selected a lender, you will certainly require to submit an application that consists of important individual information and information concerning the property you mean to purchase or refinance.

Next, the loan provider will certainly perform a preliminary evaluation of the residential or commercial property's value, typically counting on a current appraisal or equivalent sales information. This assessment is essential, as difficult cash lendings are greatly based on the home's equity instead of the debtor's credit reliability.

After the initial evaluation, the loan provider might ask for extra documents, such as proof of revenue, investment background, and a comprehensive task strategy if remodellings are entailed.

Once all necessary information is given, the lending institution will assess your application and determine the loan quantity, passion rate, and terms. If approved, the final action includes finalizing funding files and finishing the financing process, permitting you to protect your investment efficiently.

Tips for Optimizing Your Financial Investment

Securing a hard money funding is just the start of your financial investment journey; maximizing your financial investment calls for tactical planning and implementation. To achieve this, begin with extensive marketing research. Analyze fads, home values, and area characteristics to recognize profitable chances. Recognizing the local market will certainly allow you to make educated decisions and enhance your investment's possible return.

Following, think about the timing continue reading this of your financial investment. Markets rise and fall, and getting in at the ideal minute can substantially influence your earnings. hard money news loans georgia. In addition, concentrate on residential or commercial property renovations that yield the highest roi (ROI) Improvements that improve visual allure or update key features frequently bring in purchasers or renters quicker.

In addition, maintain a strong financial strategy. Track all expenditures and revenue relevant to your investment to guarantee you remain within spending plan. This economic self-control aids stay clear of unanticipated costs that can erode your earnings.

Final Thought

In conclusion, adaptable tough cash fundings offer as a vital economic tool for actual estate capitalists seeking rapid accessibility to capital. Inevitably, leveraging hard cash loans can dramatically enhance financial investment capacity and optimize returns in an affordable genuine estate landscape.

Scott Baio Then & Now!

Scott Baio Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Amanda Bearse Then & Now!

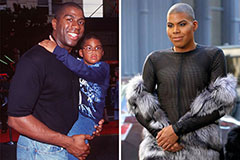

Amanda Bearse Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!